Hope Barron is a CPA in Wellington, Florida. Not only that, she’s an artist in her own right, so she understands when artists need to buy more equipment before they’ve even made sales, and when they need to hire an assistant to help them with their administrative tasks so they can concentrate on making art. Hope makes beautiful fused glass, and she uses that as her creative release to balance her time with her thriving tax accounting and consulting practice. We’ll talk about her glass for a little bit, then we’ll dig into the world of business and accounting. We talk about:

- how to set up your business

- how to keep track of your sales and expenses,

- how you will report your taxable income to the IRS

- the tax benefits of having a home office or studio

- what you need to do when you’re ready to hire employees

- and how you can set aside some money for retirement.

Listen here or use a podcast app, such as Apple Podcasts, Castbox, Spotify, or Stitcher.

Hope Barron

Hope Barron is located in Wellington, Florida. Her firm is Barron and Kogan CPAs.

If you are not in the Palm Beach County, Florida area, Hope suggests that you talk to your artist friends and small business owners to get recommendations for local CPAs in your area.

Here are some great takeaways from our conversation:

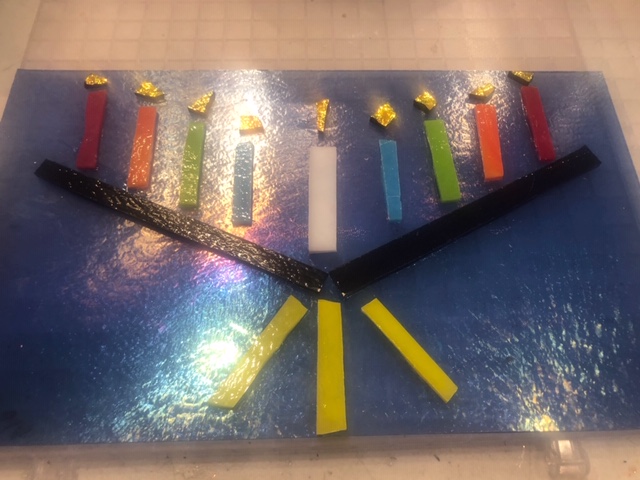

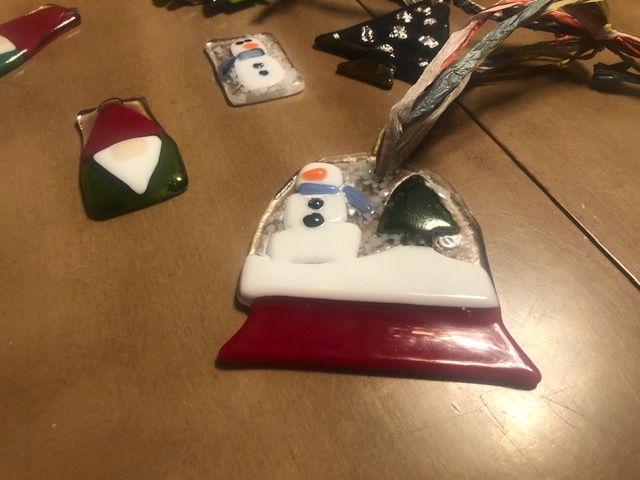

- Hope has taken fused glass classes with a local glass studio called Northwood Glass Art and Gifts in West Palm Beach, Florida. She has established a relationship with the owner of the studio who has become a mentor to her. Local shops are a great way to find experts in your art medium so that you have a source for answers and an opportunity to learn more advanced skills.

- Local stores are also a great way to use larger equipment that you may not be able to afford or fit in your own studio. Hope has a small kiln for fusing glass in her home studio, but she uses the larger kilns at her local glass store to fire bigger pieces.

- Fused glass is fun for Hope because it’s a very forgiving medium. It’s also a nice surprise when you see the finished piece. If you’re looking for an art medium or technique to try, search for classes in your area so that you can try it and see if it gives you as much joy as fused glass gives Hope.

Now for the accounting and business tips. First of all, we’ll about how you set up your business.

- When you start making art, and then you start selling your art, you need to first decide if your artmaking is a hobby or a business. Even with a hobby, you could be selling your art, but it may just be that you’re wanting to sell enough just to keep you in supplies so you can keep making more art for fun. It becomes a business when you have a profit motive, and you want to make a profit from the art that you are selling. And keep in mind, that when I say selling your art, that could also mean selling your classes if art instruction is a part of your business.

- Even if you are making art purely as a hobby, you should report on your taxes the income you are receiving, but your expenses will probably match your income. You can’t record a hobby for tax purposes as a loss. You can only do that if it’s a business.

- To make yourself a business you need to first do these two things: set up a separate bank account for your business, and set up a separate entity for your business.

- You’ll also need to set up an accounting system for your business. That can be as simple as recording your sales and expenses on an Excel spreadsheet.

- When naming your business, it doesn’t have to be the same name as what you’ve been using for your social media names. You can use your own name for your business, but it helps if it sounds more like a business. So instead of naming it Suzanne Redmond, you may want to name it Suzanne Redmond Studio or Suzanne Redmond Art.

- You can google your name to see if someone else is already using it. You can also search how to set up a corporation in your state, and when you do the set up, they will tell you if the name is available or not. For the State of Florida, the site where you set up your company is called sunbiz.org.

- There are two ways you can set up your business entity. Either as an LLC or as a Corporation. An LLC is a Limited Liability Company, and is a good choice when you are a solo business owner with no employees. You can start as an LLC and later if you get larger and have a few employees, you can convert it to a corporation.

- You’ll also want to check with your City or County to see if they have any requirements for setting up a business. They may require you to get a business license or permit. That’s usually pretty inexpensive. It’s just a way of registering with your local jurisdiction so that they know you exist as a small business.

- You also need to find out what the sales tax rate is for your State because you need to charge sales tax for products you sell. When you collect the sales tax, then you need to pay that sales tax to your State at the end of the year. Again, just google that to find out what’s included in sales tax for your state, what the rate is, and how and when you have to submit the sales tax.

Now here is how your business income will be taxed:

- When you have an LLC, at the end of the year when you do your personal taxes, you’ll just add a Schedule C to your 1040 tax return. The Schedule C is the Profit or Loss from Business, and that’s where you’ll include everything related to your business for the year.

- Your Schedule C income is what’s called Self-Employment Income. You will be taxed at the Federal level on this income and in most states you will also pay State Income Tax on this income. Florida is a state that doesn’t have State Income Tax, so we don’t need to worry about that. There will also be self-employment tax taken from this, which is the social security and medicare tax. Essentially what’s happening there is that’s how you are contributing to the social security and medicare systems for the income that you’ve made.

- Because you are paying this self-employment tax, as your income gets higher, say $5-$10,000, then you’ll want to talk to a tax preparer so that they can help you estimate what your end of the year taxes will be. You don’t want to be surprised by that and you want to be prepared and able to pay this tax when it becomes due.

- For your first year, you’ll want to put aside some money during the year so that you’ll have cash available to pay your taxes at the end of the year. Hope suggests putting aside a third of your income. For the next years, you’ll want to do quarterly payments to the IRS on your estimated taxes due. Because you are self-employed, and you don’t have an employer taking taxes out of your monthly paychecks, you’ll need to make those payments to the IRS yourself. A tax preparer can tell you the rules related to that. But basically, if you owe a large tax bill at the end of the year and you haven’t made partial payments to the IRS during the year, you could be charged penalties for not doing so.

- An accountant can look at the income and expenses that you have and advise you on whether it would be a good idea to buy a bunch of art supplies at the end of the year and expense them then, or wait until after the first of the year to buy them. This is because your expenses will offset your income on your Schedule C of your tax return. Your accountant will look at your income and determine when it makes sense to make a big purchase and therefore incur a lot of expenses.

Here are some tips on how to keep track of your income and expenses.

- Throughout the year you want to keep track of all of your art income. That would be any money you’ve received for selling an original piece of art, a print, a mural or art demo, a lecture, a class you’ve taught, or an online class you’ve sold. Those are just some examples, and I know there are lots of other ways artists can make income.

- The easiest way to keep track of your expenses is to count them as an expense in the year it was paid. That’s what’s called being a cash basis taxpayer. So for example, if you buy 20 canvases in October because it’s cheaper to buy them in bulk like that, you will count all of them as an expense in that year. Even if you haven’t painted on them yet, you’ll still count them as an expense the day you’ve purchased them. Of course, you won’t count the painted canvas as income until that canvas is sold.

- Income will count on the day you had constructive receipt of the income. That means that if someone bough art from you on December 28 and paid with a check, but you didn’t deposit that check until the new year, you still have to count it as income in the old year because that was the year that you had access to the money.

- Depreciation is a type of expense for expensive items that are expected to last for longer than a year. So for example, if you buy an expensive kiln for $2,000 and it’s expected to last for at least five years, then you can expense a portion of that price over the expected lifetime of the kiln. This is a benefit for business owners because instead of putting all of that expense in the year it is purchased, you can spread it out. You’ll get the benefit of that expense being offset against your income for many years. Think of it this way. The more income you make, the more taxes you will owe on that. But if you can offset the income with expenses, then your net income will be lower, so you’ll owe less taxes. So if you bought something for $5,000 you could expense all of that in the first year against your income. But what if you only made $2,000 in income that year? It would be better to depreciate that $5,000 piece of equipment over 5 years, and expense $1,000 per year for 5 years. Now, I’m just using this as an example. This would be something you’d talk to your accountant about and they’ll look at your income and tell you the best way to handle your expenses, and of course, the proper way under IRS tax guidelines.

- For anything that you think might be a business expense, you need to ask yourself if that expense is ordinary and necessary. You can’t deduct something unusual for a business expense. For example, if your business is making and selling oil paintings, but you want to try acrylic pour paintings, you’d have to decide if the expenses you have for buying the supplies for acrylic pouring are ordinary and necessary. They would be necessary if you’re trying to add acrylic pouring as another aspect of your business, but they would not be necessary if you just want to try it for fun.

- QuickBooks is an accounting software that is a fairly easy way to keep track of your income and expenses. You’ll have to pay a monthly fee to use it. You can find online classes or local adult ed classes that will teach you how to use it. You can also find assistants who can input all your income and expenses for you at an inexpensive rate. You’ll have to evaluate if your can afford an assistant. Realize that data entry clerks or accounting assistants have many clients. So if you’re just hiring one for a few hours a month to keep yourself up to date, that’s OK. You may find that what they can do for 2 hours might take you double that, so it would be a good use of your money to hire someone who can do it much quicker than you.

- If you’re using a Square or something like that to record sales at an art show, for example, it’s not necessary to handwrite a receipt for the purchase. But for your expenses, you should keep all your receipts. Just throw them in an envelope and summarize them using QuickBooks or whatever method you choose.

- And remember, it doesn’t need to be done on an accounting software like QuickBooks, especially when you’re first starting out. Keeping a list of income and expenses on an Excel spreadsheet would be sufficient.

We also talked about the rules of a home office. Essentially, the expenses you incur for a home office or studio can offset the income you make in a year, and therefore you’ll owe less income taxes for the year.

- You can call a portion of your home a home office if that area is solely used for business purposes. You can’t call your dining room a home office if you make art there during the day but your family eats dinner there at night.

- The biggest benefit for having a home office is that any time you are doing work for your business away from that office, you can deduct the cost of the mileage to that outside place. So for example, if you have a meeting with a client somewhere other than your home office, you can deduct the round trip mileage for going there. If you are showing your artwork at a gallery, you can deduct the mileage for going there.

- The other benefit for a home office is you can write off a portion of your home’s expenses for the cost of having a home office. So if your home office takes up 10% of your home’s square footage, then you can write off 10% of your home’s expenses, like utilities, homeowner’s association fees, etc. Please consult with your tax advisor for exactly what things and how much you can deduct for a home office.

Here’s what you need to do when you’re ready to hire employees for your business:

- First decide if you will hire an employee or an independent contractor. An independent contractor is someone you would send a 1099 to at the end of the year, and they would only be doing work for you on an occasional basis. If it’s someone who works for you on a regular basis, then they are an employee and you will pay payroll taxes for them. You will also issue a W-2 for them at the end of the year.

- The biggest thing about having employees is making your payroll tax deposits timely. There are payroll companies who can help you do that work for you. You can also check with your bank and see if they provide payroll services for their customers.

And lastly, we talked about the retirement options that are available to small business owners.

- You are able to take advantage of a SEPP, or Self-Employed Pension Plan. This is a pre-tax option for saving for retirement. Another option is a solo 401K. You can find out more about these options when you speak with your tax advisor.

- You can also take advantage of a Roth too.

Thank you very much for refreshing my memory. I closed a brick and mortar business in February 2019. I’m starting a small business in my home that also is my hobby. So, I have to change my mindset on doing things. Thank you again. Ray

You may enjoy my business episodes — they are the even numbered episodes #2-98.